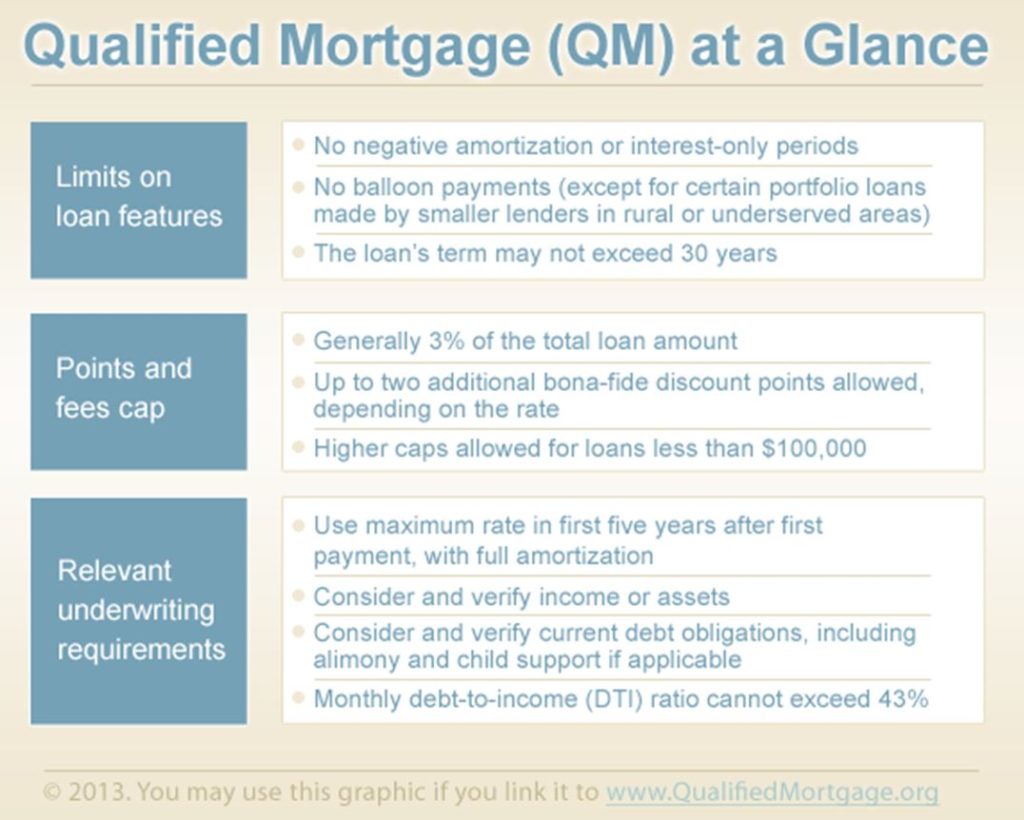

Qualified Mortgage At A Glance

What is a Qualified Mortgage?

In broad terms, all banks sell the actual mortgage loans to Freddie Mac and Fannie Mae so that they replenish their money to go make new loans. Starting January 10th, 2014, Freddie Mac and Fannie Mae will only buy qualified mortgages, which are loans that meet a very specific criteria put forth by the federal government and defined by the Consumer Financial Protection Bureau.

What does this mean for me, the home consumer?

While there are several factors within a Qualified Mortgage that are in place to protect the consumer, there are also factors that will change the structure of loans as we’ve grown to know them. A few of these factors are: No negative amortization loans, no interest-only loans, no balloon payments, no loans with terms greater than 30 years, adjustable rate mortgages qualified at the highest potential interest rate, debt to Income ratio reduced from 45% to 43% and, maximum 3% cap on points and fees – this cap includes risk adjustments imposed by Freddie and Fannie and private mortgage insurance.

Ultimately this will limit loan options for some consumers, especially first time homebuyers – mainly because of the debt to income ratio, but also because the number of loan products will be reduced (interest-only loans, for example). Mortgage insurance requirements and the possibility of real estate negotiations disqualifying a potential buyer will also be speed bumps, in addition to adding unforeseen costs to some transactions.

The good news? Since the financial crisis lenders have been tightening their lending standards anyway so it may not effect some borrowers at all, especially if you are currently working with a broker on a purchase. But, for certain groups, such as people seeking larger loans, or the self-employed, it may mean jumping though some additional hoops to get a loan.

As always, if you have questions about how the new mortgage standards will impact you, whether it be buying your first home, selling your home or buying an investment property, feel free to call and we can help you navigate your options.